For decades, Excel has been the default tool for real estate investors in Germany and beyond. It’s flexible, familiar, and great for simple financial tracking. But if you’re serious about building and managing a real estate portfolio—especially one with multiple assets—Excel will eventually fail you.

Here’s why.

1. Excel Isn’t Built for Real Estate Cash Flow Management

Tracking cash flow is critical in real estate investing. But with Excel, as soon as you manage more than one property, things get complicated:

- Rental income

- Loan repayments

- Nebenkosten (ancillary costs)

- Maintenance bills

- Property taxes

Managing all this across spreadsheets becomes chaotic. A single wrong formula can distort your net monthly cash flow, leading to poor investment decisions.

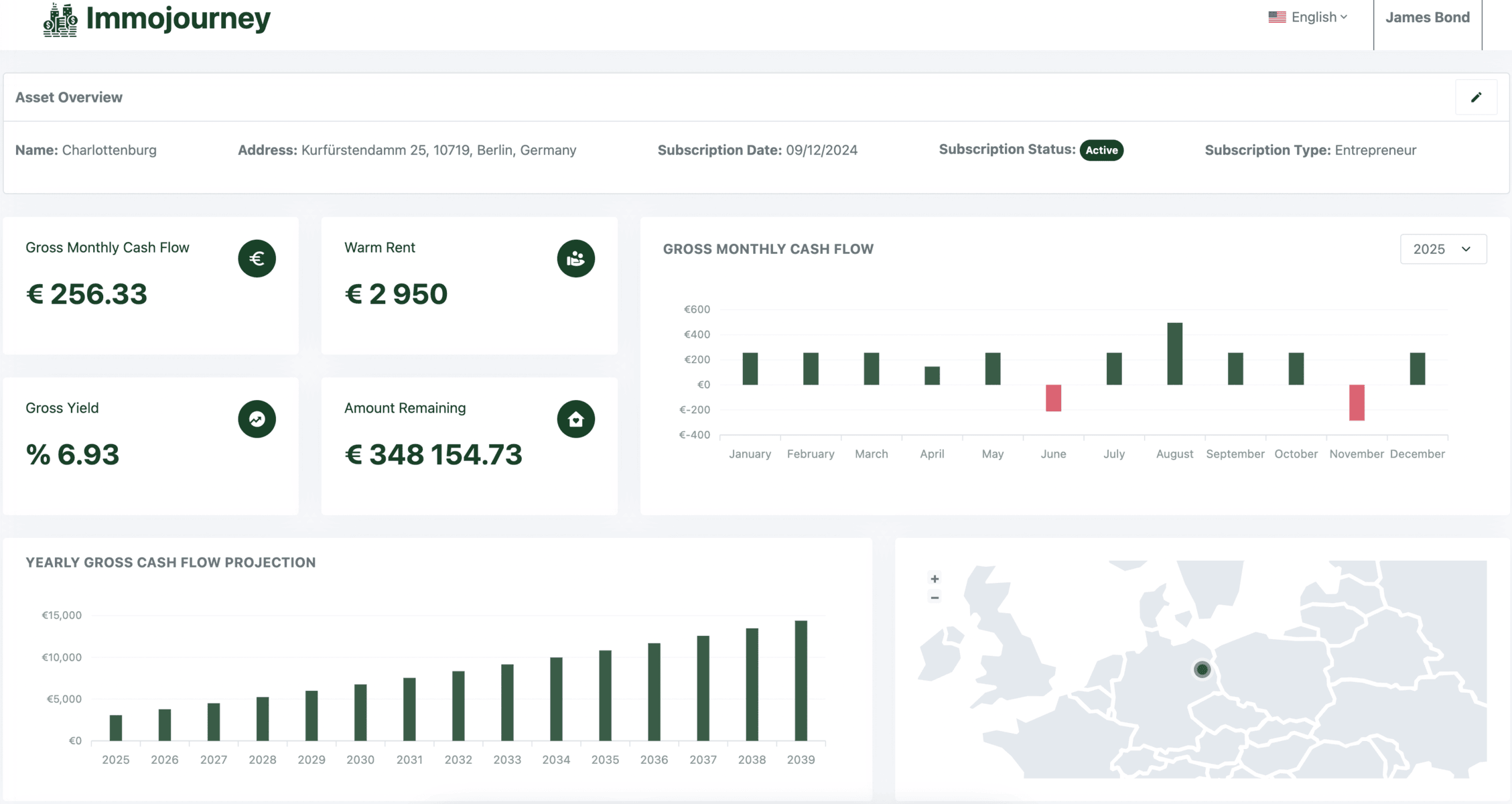

Solution: Immojourney automatically calculates real estate cash flow in real time—accurate, updated, and available in seconds.

2. Scaling Beyond 2–3 Properties? Excel Falls Apart

With Excel, each property means another sheet. Another formula. Another version.

Soon you’ll have:

- Cross-linked spreadsheets that break with every edit

- Files like “cashflow_final_v3_revised_FINAL-LAST.xlsx”

- A panic attack when your tax advisor asks for a performance summary

Immojourney solves this by offering one central dashboard for all your assets—no matter how many you own.

Track everything in one place: rent, ROI, reserves, documents, and more.

3. Excel Can’t Manage Tenants (And That’s a Problem)

Do you know:

- When your tenant’s lease ends?

- How much they pay?

- If they’ve paid on time this month?

If this info is scattered across emails, notes, or WhatsApp threads, you’re at risk.

With Immojourney’s Tenant Section, everything is stored in one place:

- Contact details

- Lease terms

- Payment history

- Notes and attachments

No more guesswork or manual reminders.

4. Documents and Bills? Scattered Chaos in Excel

Many landlords store:

- Insurance documents in emails

- Repair invoices in folders

- Tax receipts as screenshots on their phone

This is a nightmare during tax season or refinancing.

With Immojourney’s cloud-based document center, you can:

- Upload and tag documents per property

- Access them in seconds

- Share easily with your Steuerberater or advisor

5. Tax Prep in Excel? It’s Detective Work

Trying to prepare your German real estate taxes using Excel?

- Manually calculate AfA (depreciation)?

- Separate deductible vs. non-deductible costs?

- Summarize tenant payments and repair expenses?

That’s not productivity—it’s pain.

Immojourney tracks taxable income and deductible expenses for you, categorized clearly for every unit. You’re ready for tax season, not buried by it.

Excel Was Good. Until It Wasn’t.

If you’re managing high-value real estate investments, your tools should reflect that.

- Excel isn’t a real estate portfolio management platform.

- Immojourney is.

Track your cash flow. Automate tax data. Organize your documents. Understand your ROI.

Stop treating your portfolio like a spreadsheet. Start managing it like a business.

Try Immojourney today — it’s free to get started.